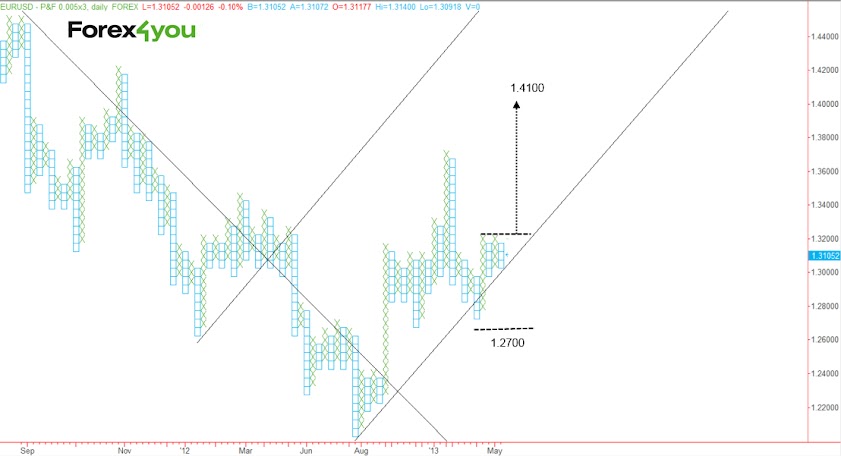

EUR/USD: Long-Term P&F Target

A long-term target of 1.4100 has been fixed on the 50 pip box point & figure chart as illustrated below. This is quite a reliable chart for trading longer-term based on results from the last 12 years. Now to activate the target and trigger a trading opportunity the exchange rate would have to move up to 1.3250 in the current column. This would also trigger a triple top continuation pattern, a further bullish sign. The stop would be placed at the 1.2700 level. The trend is up based on the 45 degree trend-line which remains intact despite recent price action which came back to find support and then bounced at the April lows.

USD/JPY: Possible Triangle Forming

The USD/JPY pair has formed a possible right-angled triangle on the daily chart. This indicates there will probably be an upside breakout, which will reach the triangle's target at 103.65. The weekly and monthly pivot clustered together at 100.70, however, could provide tough resistance to more upside, and a more cautious strategy could be to wait until that level had been breached. The bearish scenario, although less likely, would see price break down and confirm a breakdown by moving below the 97.00 lows, triggering a sell-off down to 92.90.

Analysis By: Joaquin Monfort, Forex4you Analyst

Disclaimer:

Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether currency trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Views: 32

Comment

© 2026 Created by James Dicks.

Powered by

![]()

You need to be a member of JDFN Financial Network to add comments!

Join JDFN Financial Network